Project Summary:

This project evaluates the effectiveness of school-based financial education in shaping the financial decision-making behavior of Uzbekistan’s youth. As the government increasingly integrates financial literacy into school curricula and expands training initiatives, this research provides timely and rigorous evidence on how such interventions influence young people’s economic preferences—particularly their time preferences and intertemporal financial choices.

Research Focus:

Unlike most existing studies that focus on high school students, this project breaks new ground by targeting middle school students (ages 12–13), a group often overlooked in financial education research. This early intervention approach acknowledges the importance of introducing financial concepts at a formative age, when lifelong habits and decision-making frameworks begin to take shape.

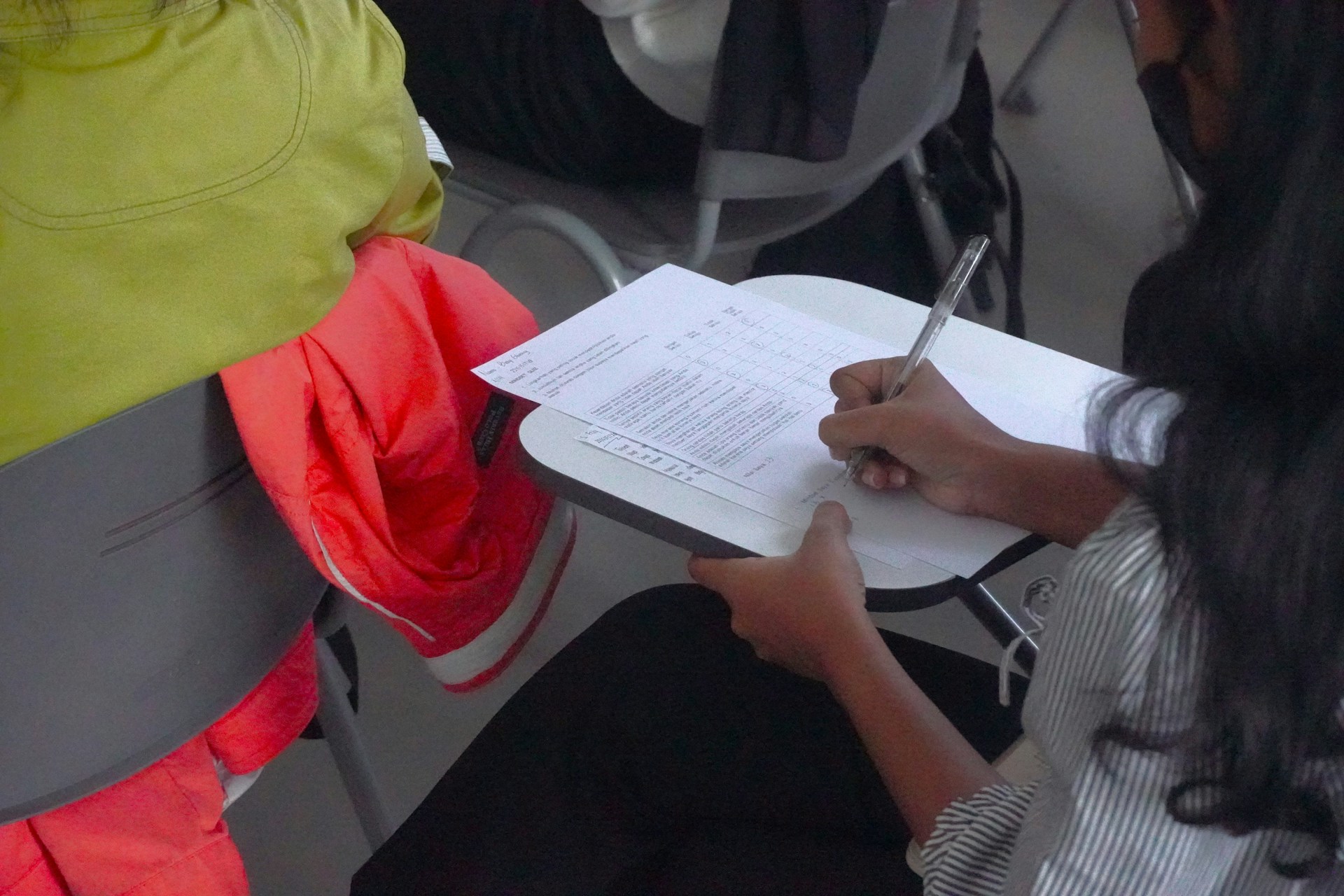

Methodology:

The study employs a Randomized Controlled Trial (RCT) design in a public middle school in Tashkent. Drawing on the experimental approach of Luhrmann et al. (2018) and based on Andreoni and Sprenger’s (2012) framework, the project assesses whether structured financial education influences students’ patience and willingness to delay gratification—key predictors of sound financial behavior.

Why It Matters:

This is the first known study in Uzbekistan to causally link financial education with intertemporal financial choices among early adolescents. The findings have implications for policy design, both within Uzbekistan and internationally, offering insights into how early, school-based financial education can build a foundation for informed and responsible financial decision-making among Gen Z youth.

Partners:

This study was conducted by the Lab for Social and Human Capital Studies in collaboration with local education authorities and school administrators in Tashkent.